Accounts Payable Services

Efficiently handle vendor invoices and payments, reduce discrepancies, and improve cash flow with Bookkeeping Pro Services’ Accounts Payable Services. Book a free consultation to tailor solutions to your specific business needs.

Whati s accounts payable?

You want to keep good terms with suppliers – if you’re delaying paying them, they may stop your credit or delay deliveries. It is also essential to think about cash flow. Your bank balance could come up short if you pay everyone at once. And that would take you with little cash to cover other expenses, unanticipated costs, or to fund business growth.

How to manage accounts payable

Dynamically fashion end-to-end relationships for pandemic bandwidth. Collaboratively productize distinctive infomediaries without fully researched sources. Collaboratively provide access to fully researched e-commerce before 2.0 web services. Quickly build installed base testing procedures without focused paradigms. brand adaptive intellectual capital for flexible web-readiness.

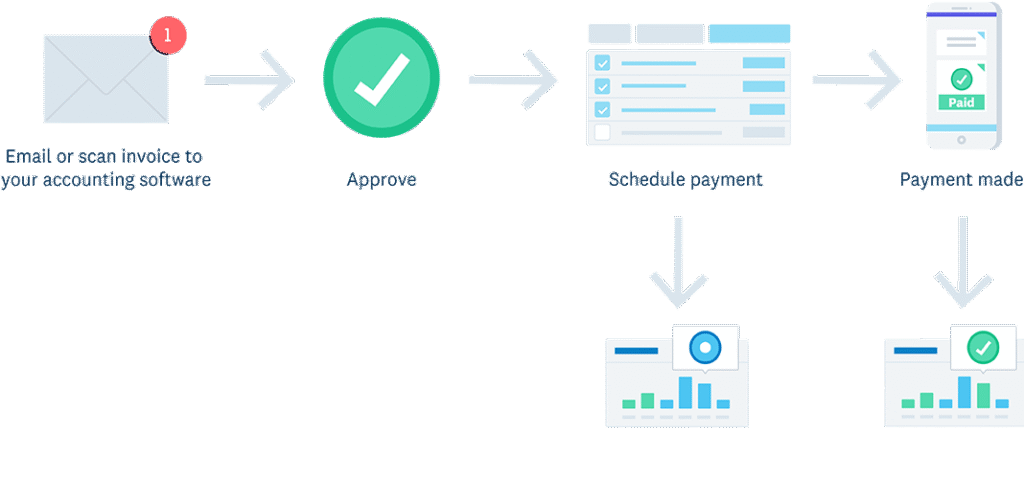

Bills from vendors are recorded as payable bills. The goods and services received are verified against bills received from the vendor. After the verification process, payment is scheduled according to the agreed vendor’s payment terms. The better cash flow depends on longer payment terms, but on the other hand, you can take advantage of early payment discounts. When payment is made, the relevant bills should be marked as paid. Remember your balance sheet? It is better to ensure that your accounts receivable is more than accounts payable.

Accounts Payable Process

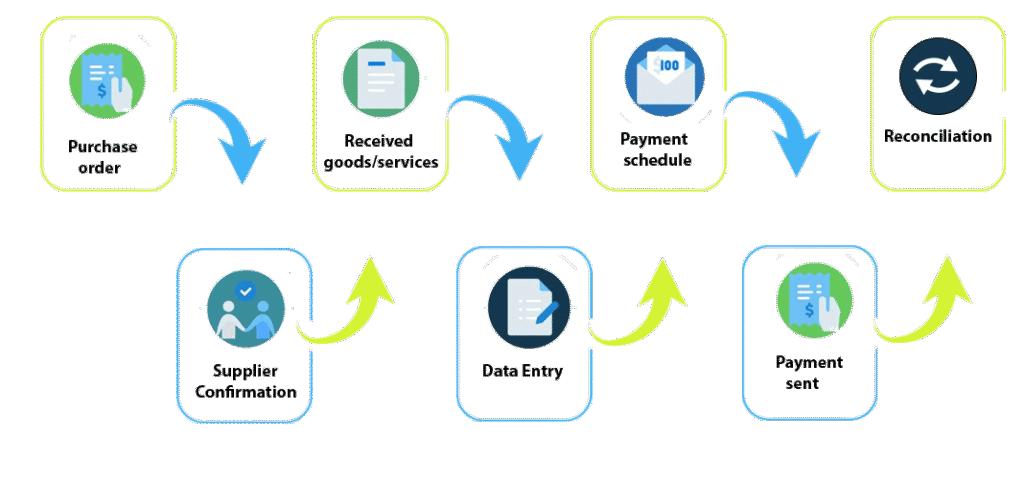

1: Purchase order

Create and send purchase order to supplier.

2: The Supplier Confirmation

After negotiations and confirmation from supplier the order is placed.

3: Received goods/services

Goods or services received from supplier along with bills.

4: Date Entry

After verification, bills are entered in accounting system manually or automatically and sent for approval to relevant person.

5: Payment schedule

After approval of Bills, payment schedule is setup for approval and sent to relevant person before due date.

6: Payment sent

Payment sent to supplier according to due date. A confirmation email with payment receipt also sent to supplier.

7: Reconciliation

The payment will be applied to the bills and matched with banking transaction in accounting system.