Accounts Receivable Services

Manage customer invoices, track customer payments, and Improve cash flow with Bookkeeping Pro Services’ expert Outsourced Accounts Receivable Services. Starting at just $15/hour.

Customer Invoicing and Account receivable Management

Every business runs on sales, and cash flow is the lifeblood that keeps it alive. Unfortunately, unpaid invoices and late payments can be detrimental to business growth. That is why invoicing and accounts receivable management are so crucial for the proper functioning of your business. We are offering comprehensive customer invoice management services to support your business entirely or partially. You can outsource the entire accounts receivable and billing operation to us, or simply select from the following services:

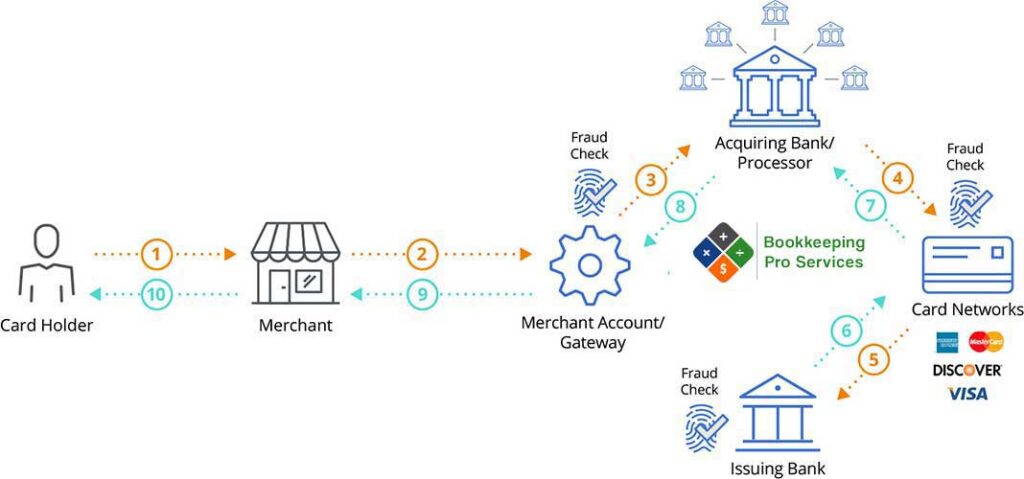

Payment Processing and payment processor Reconciliation

Every business that is selling online is using a payment processor to get payments from customers. The payment gateways and merchant processors are the two essential elements behind every eCommerce transaction. We are offering payment processing services and merchant account reconciliation services. If your payment processor balances and bank deposits do not match, you may need merchant account reconciliation services. Our team will find out the actual amount that is pending at your processor end. Why Merchant account reconciliation is necessary?

If your answer is, “Hmm, I’m not sure” to any of these questions, then you need a reconciliation of your monthly merchant account statements. Software we are using for Customer Invoicing and Account receivable Management

POS Reconciliation

Your Customer reached the store POS terminal to pay for the product to br purchased

POS System proceeds to calculate the price of product

Your Customers makes payments

POS transaction is done

Our POS reconciliation services help small business owners by finding discrepancies and streamlining financial transactions. Every retail business (Online or store in place) ower understands the need for a good point of sale system. A good point of sale system should have more than just handling payments and recording sales. It should help improve:

If selling products is the heart of your business, then a sound POS system should be the backbone. Here is the list of some best POS systems.

There is a higher chance of errors or discrepancies cropping up in the records as a business expands. A tiny error like miscalculated interest rates or incorrect payment dates sometimes provides evidence of fraud or an indication of significant financial discrepancy.

Whatever is the case, there is a lot to be gained from regular reconciliation. Bookkeeping pro services will not only safeguard your business against future problems, but you will have a much clearer understanding of the financial health of your business.